10 Tips for Power Sector

Anil Sardana, Managing Director, Tata Power provides his top 10 tips to achieve desired growth in power sector

Though the Indian power sector has made significant inroads over the last decade in the areas of policy reforms, private sector participation, new manufacturing capabilities and steady foray into the renewable energy segment, many challenges remain that affect the entire value chain of generation, transmission and distribution. Of prime concern are challenges associated with the availability of fuel, land and environmental clearances; declining health of state distribution utilities; need for the sector to mitigate climate change; and the ever-escalating cost of power for the end consumer.

But these challenges increased manifold in the year 2012, in which India is reeling under the tremendous burden from the past – a particularly weak economy due to monetary policy, stalled reforms, fiscal deficit, inflation and electricity shortages. These factors, along with fiscal and inflation concerns, have obviously cut into investment activity. In the quest to become a ‘developed nation’, rapid urbanisation has triggered a huge demand for energy, one that far exceeds the supply. During the year 2010-11, the country faced an energy shortage of 73,236 MU (8.5 per cent) and a peak shortage of 12, 031 MW (9.8 per cent). India’s per capita consumption of electricity has increased from 15.6 units in 1950 to about 571 units during the year 2009. But this pales in comparison with corresponding figures for countries such as the US (5693) and China (2631), and is much lower than the world average of 2826 units per capita. This figure is projected to rise to 1895 units by the year 2030 compared to a world average of 4128 units and that in China pegged at 6080 units. The road ahead for the Indian power sector is an uphill ride riddled with deep gaps between ‘the intended versus the actual delivery’ of the power sector.

The ’10 tips’ explained forthwith provide direction to traverse 2012:

Tip 1: Reform the DiscomsThe sector has been plagued by high distribution losses (up to 30 – 40%) and low billing recovery, which have impacted the financial health of the utilities.

Reduction of transmission and distribution (T&D) losses should be attempted through metering, feeder separation, introduction of HVDS, metering of distribution transformers and strict anti-theft measures. Distribution franchising and ESCO based structures should be considered for efficiency improvement.• Unbundling needs to be carried out on priority basis and open access to transmission strengthened • A nominal tariff increase will also be a significant step • Alternate models of distribution particularly decentralised generation using renewable energy sources could be effectively used to address the needs of the country’s rural and semi-rural communities.The government should also define a time-bound implementation plan for the pending discom reforms and accelerate implementation of open access to distribution networks. The power subsidy mechanisms for the agriculture sector also need to be reformed.

Tip 2: Develop long-term energy security policyThe need of the hour is to evolve a long-term national energy security policy. Energy supply security based on primarily domestic production and energy diversification coupled with control of greenhouse gas emission and environmental protection should constitute the core of India’s energy policy. Under this policy, the central government must consider mediating to resolve issues related to the pending fuel supply agreements for long-term fuel linkages both in India and overseas.

The policy must take into account that resources are a subject that many countries like to deal on a government-to-government (G-to-G) basis. The Indian government must, therefore, become more proactive in engaging with the countries on a G-to-G basic to secure access to scarce resources.

Tip 3: Ensure continual access to fuelSources of power must necessarily be reliable without being vulnerable to any long or short term disruptions. Interruptions of energy supplies are the biggest cause of financial losses, creating havoc in economic centres and potentially damage the health and well-being of the population. Not only is the acute shortage in fuel supply disrupting present generation capacities, it is increasingly leading to concerns that ambitious capacity addition targets may not be achieved. To ease the fuel scarcity scenario, it is essential to manage the risk of supply disruption through diversification, due diligence on suppliers, unambiguous contracting and strict monitoring among others.

Coal, oil and natural gas are the primary sources driving India’s power sector. But growth in energy supply has not kept pace with the increasing demand, thereby creating a situation of serious energy shortage. A re-alignment of the country’s fuel mix matrix can ensure disruption-free run for the power sector. Aligning itself to current contingencies, Tata Power sees imported coal as a more prominent fuel for power generation in India for the next five years as compared to LNG both due to pricing and availability

Tip 4: Liberalise domestic coal Historically, coal has been the mainstay of power production in India and it continues to be essential for meeting more than half of the country’s commercial energy requirement. Mining of domestic coal must be accorded highest priority; domestic production of coal is in deficit and even though the imports are increasing with each successive year, they are unviable and insufficient in making up for the domestic shortage.

The government must setup an inter-ministerial body for single-window clearances to fast track coal mining projects. It should introduce an independent coal regulator to oversee mining and coal development. The regulator’s primary task should be to ensure adherence to investment plans and production schedules to build a roadmap for commercial mining. By imparting adequate knowledge and training, the regulator should also ensure that developers allotted mining rights do not lack in experience in coalmine development.

Tip 5: Run for the ‘Right Environment’A ‘right environment’ is an incubator for business development. The right environment depends on several factors, but the main criterion is fewer regulatory hurdles to set up new capacities. Too much regulation demands greater due diligence. To draw business, governments must endeavour to create the right environment. For instance, Turkey is a very attractive destination because of its open market approach; almost a no-regulation zone as everyone can buy power from wherever they can. The country is proactively offering a lot of opportunities to be competitive and to be a part of the market like distribution and generation. Half the problems get resolved when the market dynamics is clear. Tata Power will go ahead if it believes that the market can absorb the investments without regulatory glitches.

Tip 6: Execute expansion plans, transparentlyGeographies for potential expansion, whether in India or abroad, must pass the three-pronged litmus test for Tata Power to establish its presence. The strategic test comprises: Firstly, that Tata Power’s presence there should be relevant to the geography; secondly, the geography should meet the company’s criteria in terms of fiscal qualification and hurdle rate; and, finally, the regulatory risk and law and order issue should also be palatable for the company.

In the African continent, Tata Power has already laid out a roadmap for expansion. It plans to set up as much as 16 GW of capacity by 2025 in Africa through joint ventures. The primary focus will be on clean fuels like natural gas, hydro, solar and wind. Where power needs are tremendous, Tata Power will also set up some coal-based projects in African geographies.

Sri Lanka, Maldives, Nepal, Pakistan and Bangladesh, which are closer home and other major Asian economies like Indonesia, Vietnam and Myanmar, are also high on the priority list. The company is also actively considering West Asian countries, especially Turkey, to set up power projects. Tata Power is running a very open race; wherever the baton-passing is faster and the company wins the race, it will make an investment.

Tip 7: Focus on renewable energy for sustainable electricity sector Special focus should be provided to renewables by identifying high intensity renewable “zones” and establishing all enablers (land, transmission, site approvals etc) therein. The government should ensure effective implementation of the National Solar Mission, including clear policy on feed-in tariffs. Distributed generation for rural areas (to benefit from solar & bio-mass applications) should be encouraged through special incentives and fast track clearances.

Tip 8: Distributed decentralised generationFor a large and dispersed country like India, it is critical to be innovative in generating clean energy sources that care for the environment and the deprived sections of society. Rural household energy expenditure today is marked by lack of access to reliable electricity grid and the availability of inexpensive fuels like wood and kerosene.

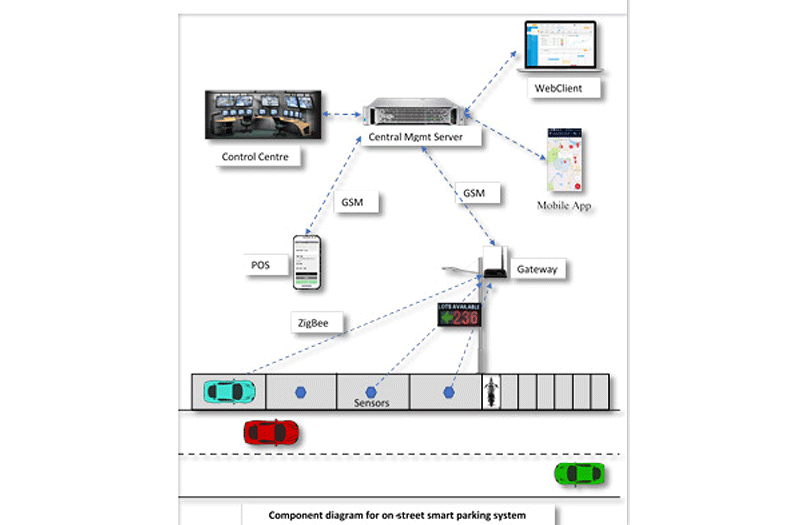

Distributed decentralised generation (DDG) offers the possibility of creating micro-grids (within the utility’s overall framework) to cater to groups of consumers in a well-defined geographical region. Distributed generation technologies include turbines, micro-turbines, wind turbines, biomass and gasification plants. In fact, de-centralised plants based on renewable energy sources present appropriate solutions for rural India where it would be impossible to take grid power such as in the hilly areas.

Tip 9: Facilitate efficient market side developmentThis may be achieved through the following endeavours: Accelerated the pace of reforms by the government in power exchanges and deregulate the trading segment; rolling out initiatives to smoothen peak demand curve and promote peaking power supply; introduction of flexibilities in PPA tenure and promotion of real time market mechanisms, through time of day; and, metering and pricing could be undertaken to enable efficient market development.

Tip 10: Governance is the keyThe power sector is facing a complete lack of coordination among various arms of the Government that have a major say in the sector’s development. Decisions are often taken in a knee-jerk and haphazard manner. The net result is that the power sector continues to be in as bad a shape, if not worse, than what it was in the early 1990s, when the first so-called attempts at improving the sector were taken. For a positive turnaround for the power sector in 2012, the ‘policy paralysis’ must end. Proactive, well-considered and much-awaited reforms need to be enacted.

In the wake of the sluggish business environment presently underway, 2012 needs to be used as an opportunity to actualise holistic reform of the power sector with multi-sectoral approach. In the absence of such reform, India will continue to lag behind its inherent growth potential.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.