“Most probably centre would lay down some basic minimum criteria which are sacrosanct and which need to be adhered to at all cost and based on that each state will be given the freedom to shape their own policies,” says D K Vyas, CEO, Srei BNP Paribas

Srei BNP Paribas is a major player in the infrastructure and construction equipment (ICE) financing business in India with a market share of about 30 per cent. In an exclusive interview with ACE Update, D K Vyas observes that the high interest rate regime is hurting the prospects of infrastructure financing. He also outlines the pressing issues that the new government should address with utmost priority.

How do you look at the current pace in infrastructure industry? I think having a government at the centre with absolute majority is the best thing that can happen for the infrastructure sector. With no coalition pressure, I now expect a lean and compact cabinet with each minister in charge of multiple related portfolios. For example, if instead of multiple ministries like road, railways, shipping, civil aviation, if there is one ministry of transportation with separate departments for road, rail, shipping, civil aviation, and each being headed by a secretary who would be reporting to the minister – just imagine how efficient the entire planning and coordination process can be. Optimum use of resources can then become a reality in planning and implementing the route networks for various modes of transportation. Similarly, a minister for energy can be in charge of power, coal, oil and gas and maybe mining too.

I have been following the election speeches of Narendra Modi. What I realised is that having been the Chief Minister of a state for over a decade, Mr Modi believes in autonomy of the state governments. Thus, I am upbeat that he envisages a greater role for the state governments in shaping the rules and regulations pertaining to issues like land acquisition, environmental clearances, etc.

Most probably centre would lay down some basic minimum criteria which are sacrosanct and which need to be adhered to at all cost and based on that each state will be given the freedom to shape their own policies. Such an approach would be a boon to infrastructure creation. This will set in motion a healthy competition among state governments in attracting investments and that, in turn, will augur well for the overall development of the economy. Thus, I am extremely upbeat about this sector at this juncture. Maybe we should allow this new government some 3-4 months to settle down, and thereafter I foresee the pace of infrastructure to pick up in a major way post-monsoon.

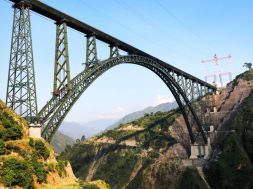

The roads and bridges sector awaits a much-needed thrust. Being one of the major players in the equipment finance industry, what are the difficulties you are facing? What are your strategies in place to deal with the given situation?While PPP has been the preferred mode of infrastructure creation in India, the present mess in the road sector is also a PPP creation. Both government and private sector need to share the blame. Till 2011-12, the progress of NHDP had elicited interest of investors from around the world and helped bring in substantial investments into the road sector. However, 2012-13 onwards, weak financial position of concessionaires and developers in the road sector, delays in project clearances, problems in land acquisition, unrealistic bids, faulty traffic projection and a host of other factors emerged as major stumbling blocks for this sector. It is the BOT (build-own-transfer) projects which have been affected the most. Of late, there has been a growing inclination towards moving away from BOT and instead settle for EPC (engineering-procurement-construction) projects. However, from our experience, we strongly feel that to continue the momentum in the highway sector, there should be both EPC and BOT projects.

With commercial banks having the maximum exposure to infrastructure projects, the asset-liability mismatch problem forces loan repayment to be front-loaded. Concessionaires face problems making the payments as revenue from the projects typically grows as the concession matures. Thus, servicing the loan in the initial years becomes a major challenge. Going forward, a financial structuring of an infrastructure project like a typical BOT-Toll road project can be thought of. Considering the concession period for a BOT-Toll road project of 25 years with a door-to-door debt tenure of maximum 15 years (which is generally the case these days), a financing structure can be formed where the repayment schedule is such that 50 per cent of the total debt is repaid during the loan period and balance 50 per cent is to be repaid by way of bullet payment at the end of the loan period. The bullet payment shall be made by arranging refinancing of the balance 50 per cent debt, repayable over the remaining concession period. This would help the project in overcoming from the cash flows stress during the entire concession period (i.e. 25 years) as the repayment of debt is practically getting spread out over the entire concession period for the project vis-à-vis 15 years under the present structure.

Of course such an arrangement must be backed up by the government stepping up its role as a public partner by helping land acquisition, getting clearances pertaining to environment, forests, etc. so that private sector is encouraged to invest in road building.

As regards to our approach in dealing with financial stress, I feel the immediate answer to mitigating that risk is prudence. All lenders, NBFC or bank, must act prudently and conduct thorough due-diligence checks on customer profiles before each disbursement. Maintaining credit quality and minimising NPAs are extremely important. While our disbursement criteria are similar to market practices, our ability to provide customer centric solutions makes us more flexible. Our approach for financing has always been risk based evaluation and primarily from a cash flow perspective. We take a position on the project, our client and the quality of the asset. We, at Srei Group, have consciously reduced our exposure to our strategic customers, as that helps in reducing the concentration risk.

We believe in a partnership approach, and whenever our customer is facing a problem in servicing the loan, we try to assist in whatever way possible, be it in terms of rescheduling their payment cycle, or restructuring the financing arrangement, or helping them find new projects or re-deploying their assets. We are into asset-backed lending and thus the asset itself is a key risk mitigant for us. But repossession of an asset is always the last option for us. Joining hands with the manufacturer partners, we try our level best to address the concerns of our customers, because their growth ensures our growth.

Is the current monetary policy conducive for NBFCs in equipment finance or do you expect norms to be eased further?The high interest rate regime is definitely hurting the prospects of infrastructure financing. RBI has made its intentions clear that they want to link the policy rates with the Consumer Price Index (CPI) inflation number, and move away from the erstwhile practice of linking it to the Wholesale Price Index (WPI) inflation number. Keeping in mind that CPI inflation is still quite high, I do not foresee RBI going for any cut in policy rate in the next couple of months. At the same time, I do not expect RBI to hike policy rates too, until and unless something drastic happens and inflation shoots up. Thus, I feel policy rates will stagnate for sometime now.

What are your expectations from the new government? What are the pressing issues that the new government should address with utmost priority?I have already touched upon these points before. I expect infrastructure creation to figure topmost in the new government’s agenda. They should devote the first few months to put in place the right policies. Also, it must set in motion the stalled infrastructure projects.

The government needs to urgently work towards consensus-building among all stakeholders to ensure the introduction of Goods & Services Tax (GST). Direct Tax Code (DTC) but take some more time. But introduction of GST and DTC will bring in a lot of clarity in terms of tax implication for the businesses and that would help in reviving investor interest. In addition, GST can help the central government in mobilising resources which it can then use to productive use. Keeping in mind the tight fiscal situation it is in now, the central government should itself be keen to ensure roll-out of GST.

India is a land of entrepreneurs. Thousands of small and medium entrepreneurs scattered throughout the country constitute the backbone of the India growth story. The new government would need to review ‘The Companies Act 2013’ which has introduced a plethora of compliance norms and archaic rules which will make life extremely difficult for India Inc. Due to this Act, even unlisted companies are now expected to comply with multiple norms which earlier applied only on the listed companies. Small unlisted players neither have the expertise nor the wherewithal to understand and comply with these norms. Leave aside the smaller players, even the bigger entities are finding it difficult to comply with all the norms and thinking of investing abroad. Precious entrepreneurial talent will get nipped in the bud and there would be a flight of capital too. Thus, review of the Act should be another item in the new government’s priority agenda.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.